Employee Benefit Plans

Leave of Absence

A leave of absence requires a lot of planning. We have made the process easier for you, explaining what happens to your benefits depending on the type and length of your leave.

There is a lot to consider when taking a leave of absence or when you find yourself in an unplanned leave of absence. We hope to make the process easier for you by answering some frequently asked questions below on how a leave of absence affects your benefits.

Some of your benefits continue automatically for a period of time if you pay premiums, such as your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) insurance coverage, and your health and dental benefits. You have the option to elect to continue Optional Life insurance and the Disability Income Plan coverage.

Going on an approved unpaid leave of absence

Under the terms of the Employee Benefit Plans, an unpaid leave of absence is an employer-approved period of 30 days or more when you will be away from work and not receiving your regular pay. You must discuss your planned leave with your employer and receive their approval according to your workplace policies before starting the leave of absence.

The most common types of leaves include maternity and parental, personal, illness, and education leaves.

Your employer will notify 3sHealth when they have approved your leave of absence.

You will need to request approval for your unpaid leave of absence from your employer.

Before you leave work on your approved leave of absence, you must make premium payment arrangements with your employer for your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) coverage.

You must also fill out the “Leave of Absence - Disability and Optional Group Life Continuation” form and return it to your employer to either continue or stop your disability and Optional Life insurance coverage.

Deadline to note: You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue neither your disability nor your Optional Life insurance coverage.

It is important for you to weigh your options and consider what type of coverage you need during your leave.

If you choose to stop your Optional Life coverage while on leave and if you want to elect for this optional coverage again when you are back to work, you will need to re-apply. This application will include a medical questionnaire for coverage.

If you choose not to continue your disability coverage while on leave, your coverage will resume only once you have actively returned to work.

Continuing Basic Life insurance is mandatory during an unpaid leave of absence. You will need to arrange to pay your premiums to your employer. You need to make this arrangement because your employer cannot collect premium deductions from your pay during an unpaid leave of absence.

If you have elected to continue your disability and/or your Optional Life insurance, you will have to set up a similar premium payment plan.

Your employer will work with you to set up a premium payment plan. The most common payment method is to provide your employer with either post-dated cheques or your banking information to set up monthly pre-authorized debits from your bank account.

Make sure to set up your payment plan before your leave begins.

Submit the form to your employer as soon as possible and within 30 days of the start of your leave of absence. After 30 days, you will not be eligible to continue neither disability nor Optional Life insurance coverage.

Do I have benefits while on leave? Common types of leaves and your benefits

Your benefits coverage during a leave of absence depends on the type of leave. This section provides benefit coverage details for the type of leave you are planning.

Health and dental: Your health and dental benefits will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave, provided you were actively at work prior to the start of your leave or on an approved unpaid illness or disability leave. If you were on any other type of leave (eg. Education), your 18 months of coverage would be based off of the start of your original leave.

Group Life insurance: Your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) insurance will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave, provided you were actively at work prior to the start of your leave or on an approved unpaid illness or disability leave. If you were on any other type of leave (eg. Education), your 18 months of coverage would be based off of the start of your original leave. The plan requires that you pay your premiums while on your leave to maintain your coverage.

You have the option to continue your Optional Life insurance for up to 18 months from the start of your leave. Your Optional Life insurance includes your Voluntary AD&D insurance. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue Optional Life insurance coverage.

Disability Income Plan benefits: You have the option to continue your disability income coverage for up to 18 months from the start of your leave. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue disability coverage.

Health and dental: Your health and dental benefits will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave.

Group Life insurance: Your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) insurance will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave. The plan requires that you pay your premiums while on your leave to maintain your coverage.

You have the option to continue your Optional Life insurance for up to 18 months from the start of your leave. Your Optional Life insurance includes your Voluntary AD&D insurance. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue Optional Life insurance coverage.

Disability Income Plan benefits: You have the option to continue your disability income coverage for up to 18 months from the start of your leave. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue disability coverage.

The bridge portion of an approved disability claim lasts up to a maximum of 119 days from the initial date of disability for CUPE and SEIU-West employees only. During this period, the plan requires that you pay premiums for your Basic Life insurance to your employer. During the approved bridge coverage period, you continue to have disability, health, and dental coverage and you do not need to pay premiums.

When you are on an approved long-term disability claim, the plan waives the need for you to pay premiums for the coverage that remains in effect for you: Basic Life insurance, Basic Accidental Death & Dismemberment (AD&D), Dependent Life insurance, and Optional Life insurance. Your Optional Life insurance includes any Voluntary AD&D insurance you have.

Your Extended Health Care and Enhanced Dental Plan insurance remains in effect while you are on an approved long-term disability claim for up to two years and 119 days from your date of disability. After two years and 119 days, you have the option to join the GMS 3sHealth Retiree Benefits Plan to get coverage if you remain on an approved disability claim.

In the event your physician diagnoses you with a terminal illness, you may request an “Early Death Benefit” payment of up to 50 per cent of your basic Group Life insurance coverage or $50,000, whichever is less. To be eligible, you must have a terminal diagnosis with a life expectancy of less than 24 months. Please contact us to advise that you will be applying. We will provide forms for you and your physician to complete. An approved Early Death Benefit application reduces the Basic Life insurance amount payable to your beneficiaries by the advanced amount. If you survive past the 24-month life expectancy, you do not need to pay back the advance; the advanced payment amount will reduce the Basic Life insurance amount payable to beneficiaries upon your death.

When you are on an approved disability claim, you are not required to make contributions to your Saskatchewan Healthcare Employees' Pension Plan (SHEPP). You will continue to receive credited service and build your pension throughout the approved disability period, even though no member or employer contributions are payable to the plan.

If you are a member of the Public Employees Pension Plan (PEPP), you make pension contributions during your disability claim. 3sHealth deducts these contributions from your disability payment and sends the contributions to PEPP on your behalf. If you are a member of a different pension provider other than either SHEPP or PEPP, contact your pension provider to see how being on an approved disability claim affects your pension.

Health and dental: Your health and dental benefits will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave.

Group Life insurance: Your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) insurance will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave. The plan requires that you pay your premiums while on your leave to maintain your coverage.

You have the option to continue your Optional Life insurance for up to 18 months from the start of your leave. Your Optional Life insurance includes your Voluntary AD&D insurance. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue Optional Life insurance coverage.

Disability Income Plan benefits: You have the option to continue your disability income coverage for up to 18 months from the start of your leave. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue disability coverage.

Health and dental: When you are on an unpaid illness leave of absence your health and dental benefits will automatically continue at your current level of coverage for up to 18 months from the start of your leave.

Group Life insurance: Your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) insurance will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave. The plan requires that you pay your premiums while on your leave to maintain your coverage.

You have the option to continue your Optional Life insurance for up to 18 months from the start of your leave. Your Optional Life insurance includes your Voluntary AD&D insurance. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue Optional Life insurance coverage.

Disability Income Plan benefits: You have the option to continue your disability income coverage for up to 18 months from the start of your leave. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue disability coverage.

In the event your physician diagnoses you with a terminal illness, you may request an “Early Death Benefit” payment of up to 50 per cent of your basic Group Life insurance coverage or $50,000, whichever is less. To be eligible, you must have a terminal diagnosis with a life expectancy of less than 24 months. Please contact us to advise that you will be applying. We will provide forms for you and your physician to complete. An approved Early Death Benefit application reduces the Basic Life insurance amount payable to your beneficiaries by the advanced amount. If you survive past the 24-month life expectancy, you do not need to pay back the advance; the advanced payment amount will reduce the Basic Life insurance amount payable to beneficiaries upon your death.

You may be eligible to apply for disability benefits. Please visit this page to apply.

Employment Insurance (EI) compassionate care benefits provide financial assistance while you are away from work to care for or support a critically ill or injured person or someone needing end-of-life care. Learn more on the Government of Canada’s website.

If you are receiving EI compassionate care benefits, here is what you need to know about your benefits:

- Your health and dental benefits will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave.

- Your Basic Life insurance and Basic Accidental Death & Dismemberment (AD&D) insurance will automatically continue at your current level of coverage during your approved leave of absence for up to 18 months from the start of your leave. The plan requires that you pay your premiums while on your leave to maintain your coverage.

You have the option to continue your Disability Income Plan coverage and Optional Life insurance for up to 18 months from the start of your leave. Your Optional Life insurance includes your Voluntary AD&D insurance. You will need to arrange premium payment with your employer. You must submit your decision to either continue or stop your coverage within 30 days of your last day of work. After 30 days, you will not be eligible to continue neither disability nor Optional Life insurance coverage.

If you are on an approved WCB claim, your employer may be able to provide a payment “net-pay top-up” for the first year. This “net-pay top-up” is an amount your employer pays in addition to your WCB benefits to provide you with 100 per cent of your pre-disability net pay. During this period of net-pay top-up, you continue to receive your payments from your employer. You continue to receive credited service towards your pension and your benefit premiums stay the same as when you were actively at work. After one year, WCB will pay you directly if your disability claim is still active.

In these cases, it would be advantageous for you to submit a disability claim to 3sHealth 90 days before the end of the net-pay top-up period and before one year after the date of disability. An approved disability claim allows you to receive a “waiver of premiums.” This waiver means that, while on an approved long-term disability claim, you do not have to pay premiums for your Group Life insurance. There is no cost to you for your Basic Life insurance, Basic Accidental Death & Dismemberment (AD&D) insurance, Dependent Life insurance, and Optional Life insurance. Your Optional Life insurance includes any Voluntary AD&D insurance you have. Your Extended Health Care and Enhanced Dental Plan benefits would remain in effect for up to two years and 119 days from your date of disability. After two years and 119 days, you have the option to join the GMS 3sHealth Retiree Benefits Plan to get coverage.

Visit this page to apply for disability income coverage.

Please note that the Disability Income Plans state that WCB benefits are an offset of the Employee Benefit Plans disability benefit payment, meaning that WCB income reduces any benefit payment you receive from 3sHealth.

If your leave of absence is due to a motor-vehicle accident, you may be eligible to apply for disability coverage under your Employee Benefit Plans.

After the initial 119 day qualifying period, a plan member can apply for long-term disability benefits. An approved long-term disability claim with 3sHealth allows you to receive a “waiver of premiums.” This waiver means that, while on an approved disability claim, you do not have to pay premiums for your Group Life insurance. There is no cost to you for your Basic Life, Basic Accidental Death & Dismemberment (AD&D), Dependent Life insurance, and Optional Life insurance. Your Optional Life insurance includes any Voluntary AD&D insurance you have. Your Extended Health Care and Dental insurance would remain in effect for up to two years and 119 days from your date of disability. After two years and 119 days, your health and dental benefits end, and you have the option to join the GMS 3sHealth Retiree Benefits Plan to get coverage.

Please note that the Disability Income Plans state that SGI benefits are an offset of the Employee Benefit Plans disability benefit payment, meaning that SGI income reduces any benefit payment you receive from 3sHealth.

If you choose not to apply for disability or you are not receiving Disability Income Plan benefits, your health and dental and Group Life insurance benefits can remain in place for a maximum of 18 months from the start date of your leave.

You have 30 days from the start of your leave to choose whether you continue your Disability Income Plan and Optional Life insurance coverage. If you elect to continue by filling out the “Leave of Absence - Disability and Optional Group Life Continuation” form and returning it to your employer, you will need to pay premiums to your employer.

There is a limited window to apply for disability. We recommend you apply as soon as possible. Please see below for the important timelines for applying.

When to apply:

- If you are a member of the CUPE or SEIU-West Disability Income Plan, 3sHealth must receive your application for bridge benefits within 90 days of whichever comes later:

- The date of your injury or illness;

- The end of earnings from your employer (such as paid sick leave or paid vacation);

- The initial denial of your WCB or SGI application; or

- The end of employer-paid net top-up benefits while on WCB.

- For long-term disability benefits, 3sHealth must receive your application within:

- The end of the 119-day qualifying period and no later than six months after the start of your injury or illness;

- The later of six months after the start of your injury or illness, or 90 days after the end of employer paid net top-up benefits while on an approved WCB claim; or

- The later of six months from the start of your injury or illness, or 90 days after the initial denial of your WCB or SGI application.

If you apply and your disability application is approved: | Benefit | If you do not apply or if your application is not approved: |

| You will continue to receive credited service under the plan during your approved disability claim. Contributions are not required during your approved long-term disability claim. | Saskatchewan Healthcare Employees' Pension Plan (SHEPP) | You will not receive credited service after your employer-paid sick leave or salary continuance ends. |

| Your coverage remains in effect for the duration of your approved long-term disability claim. There is no cost to you. Coverage includes Basic Life insurance, Basic Accidental Death and Dismemberment (AD&D), Dependent Life insurance, and Optional Life insurance. | Group Life insurance | Your coverage for Basic Life insurance must continue for 18 months. You are responsible for paying the premiums. You can elect to continue Optional Life insurance for up to 18 months. You are responsible for paying the premiums. All life insurance will terminate at the end of 18 months. |

| Your coverage will remain in effect for up to two years and 119 days from your date of disability. After two years and 119 days, you will have the option to join the GMS 3sHealth Retiree Benefits Plan. | Extended Health Care and Enhanced Dental Plan | Your coverage will continue for up to 18 months. All Extended Health Care and Enhanced Dental Plan insurance will terminate at the end of 18 months. |

Extending my leave beyond 18 months

Your benefits continue during a leave of absence to a maximum of 18 months. If your leave of absence extends beyond 18 months and you do not return to work immediately following your leave of absence, then your Group Life insurance, Disability Income Plan, and Extended Health Care and Enhanced Dental Plan coverage will terminate on the first day following 18 months.

No. Your coverage does not continue unless you are currently on an approved disability claim.

No. Your health and dental coverage does not continue beyond 18 months on a leave of absence if you do not return to work.

Yes! During the 31-day period after the end of your leave of absence, you have the option to convert the amount of your Basic Life, Dependent Life, and Optional Life insurance coverages to an individual insurance policy with Canada Life up to a total amount of $250,000. You must make both the application for the individual converted policy and your first premium payment within this 31-day period. The plan does not allow for any exceptions to this 31-day application period.

Steps to convert:

- You must consult with a financial advisor. The advisor will ensure that you receive the professional advice necessary to make an informed decision. If you do not have a financial advisor, Canada Life can help you find one.

- You need to complete a “Group Life Conversion Option” form. Please contact 3sHealth Employee Benefits. We will provide you with the form you need.

- Send the completed form to Canada Life as specified on the form.

- Canada Life will provide you with the information on premium costs.

For more information please reference the Group Life Conversion Member Fact Sheet or the Group Life Insurance Plan Booklet.

Returning from leave

Your employer will notify 3sHealth when you return to work. Effective the first day you are back to active duty, and you are receiving pay from your employer, the plans fully reinstate your Basic Life insurance, Dependent Life insurance, Accidental Death & Dismemberment (AD&D) insurance, disability coverage, and health and dental benefits to your pre-leave level of benefit coverage.

Yes! If you chose to stop your Optional Life insurance coverage while on leave and if you want to elect for this optional coverage again when you are back to work, you will need to re-apply. This application will include a medical questionnaire for coverage. Please contact 3sHealth Employee Benefits. We will provide you with the form you need.

If you are a part-time, casual, or temporary employee, 3sHealth will measure your hours worked each year on December 31 to determine your eligibility for benefits.

3sHealth will measure you on December 31 of the year you returned to work, based on any hours you worked in the year plus any eligible deemed hours for the year. Your employer will not be able to report any deemed hours beyond the first 12 months of your unpaid leave of absence. You may gain, lose, or maintain your level of benefits because of the annual measure.

Deemed hours represent the straight-time hours you would have worked had you not been on a leave of absence. Your employer reports deemed hours for other-than-full-time employees for only the first 12 months of your leave. Deemed hours are part of the calculation of your benefits for the next calendar year.

We do not measure full-time employees because they have guaranteed hours and maintain their full-time level of benefits coverage.

Yes. You can request that 3sHealth perform a one-time measurement of your eligibility following your return to work.

3sHealth does not measure plan members who are not actively at work due to an approved leave of absence until December 31 of the year that they return to work. When a plan member returns to work, we reinstate their pre-leave level of coverage. This level of coverage remains until the plan member’s next annual measurement on December 31.

Plan members can request that we run a one-time manual measurement upon the plan member’s active return to work. We will use any actual hours worked in the previous calendar year plus any deemed hours.

Deemed hours represent the straight-time hours you would have worked had you not been on a leave of absence. Your employer reports deemed hours for other-than-full-time employees for only the first 12 months of your leave. Deemed hours are part of the calculation of your benefits for the next calendar year.

It is important to understand that the results of this manual measurement may adversely impact a plan member’s level of coverage. The results of the measurement are binding.

The results of the measure could be that a plan member’s coverage:

- Remains at their pre-leave level of coverage.

- Increases to a higher level of coverage.

- Decreases to a lower level of coverage.

- Goes away, as they could lose their coverage for the remainder of the calendar year.

To be eligible for benefits, a plan member must have worked a minimum of 780 hours in the previous calendar year. We will pro-rate coverage based on the percentage of full-time hours the plan member works.

We will only complete the manual measure after receiving a written request from the plan member.

The plan member can make their manual measure request by contacting 3sHealth Employee Benefits.

Deemed hours represent the straight-time hours you would have worked had you not been on a leave of absence. Your employer reports deemed hours for other-than-full-time employees for only the first 12 months of your leave. Deemed hours are part of the calculation of your benefits for the next calendar year.

Full-time employees do not have deemed hours because they have guaranteed hours and maintain their full-time level of benefits coverage.

On December 31 each year, 3sHealth measures all other-than-full-time employees to determine their eligibility for benefits in the next calendar year. This measurement is based on actual hours worked. You must work a minimum of 780 hours in the calendar year to be eligible for benefits.

When you are on an approved leave of absence, you are not working. However, your employer will submit the hours that you would have worked had you been actively at work. These are “deemed hours.”

Your employer calculates deemed hours from the first day of your leave of absence up to a maximum of 12 months. If you are taking a leave of absence that is less than 12 months, your deemed hours will be equal to the length of your leave. If you are taking a leave of absence greater than 12 months, employers will only calculate deemed hours for the first 12 months of your leave.

You should discuss deemed hours with your employer before you begin your leave. This discussion will help you understand any impact your leave of absence could have on your benefit coverage following your return to work.

Example one:

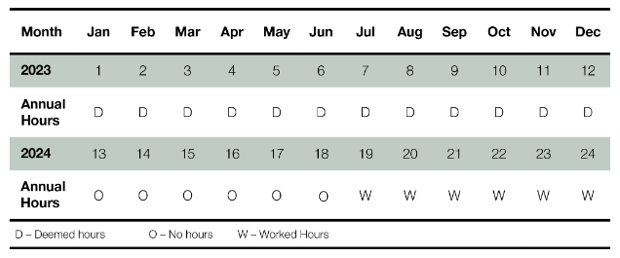

Jennifer is taking an eight-month personal leave of absence beginning on January 1, 2023. Her employer has approved her leave. She holds a permanent part-time position and usually works three six-hour shifts each week. When Jennifer returns to work on August 31, 2023, she will return to the same level of benefits she had before her leave began. On December 31, 2023 3sHealth will measure Jennifer based on her actual hours worked in 2023, plus her deemed hours for the eight months of her leave of absence to determine Jennifer’s benefit eligibility for 2024.

Example two:

Rhea is taking an 18-month maternity leave of absence beginning on January 1, 2023. Her employer has approved her leave. She holds a permanent part-time position and usually works three six-hour shifts each week. When Rhea returns to work on July 1, 2024, she will return to the same level of benefits she had before her leave. On December 31, 2024, 3sHealth will measure Rhea based only on her actual hours worked in 2024. Deemed hours are not applicable here because her deemed hours ended in 2023. The annual measure only factors in the previous calendar year. In this case, 2024. 3sHealth will only use Rhea’s hours worked for the period of July 1, 2024, to December 31, 2024, to determine her benefit eligibility for 2025.

Questions

3sHealth administers your Employee Benefits Plan. We are happy to answer any questions you have. This page contains our contact information.

Available below are the links to some pension providers’ contact web pages:

- Saskatchewan Healthcare Employees' Pension Plan (SHEPP).

- Public Employees Pension Plan (PEPP).

- Regina Civic Employees' Superannuation & Benefit Plan.

- All Other Pension Plans: Contact your employer or pension plan provider for details.

Available below are the links to different disability plan administrators:

Related Links

- Life Event: New Employee

Congratulations on your new role! This is an exciting time for you. You have questions about your benefits, and we have answers. - Life Event: Family Changes

Family changes such as new children, changes in marital status, and children attending post-secondary education all affect your benefits. Learn what you need to do to keep your benefits updated. - Life Event: Retirement

Planning your retirement? You have options when it comes to your benefits. Get answers to your frequently asked retirement questions here. - Life Event: Death

Dealing with the loss of a loved one can be very overwhelming. This section contains information on life insurance, keeping beneficiaries up to date, and what next-of-kin and executors need to know.